Building & Infrastructure

MANAGING RISK WHILE SECURING HUD FINANCING: A Guide to Bridge to HUD!

juil. 26 2021

There are many advantages to pursuing a HUD loan, but the lengthy processes of securing the commitment from HUD can make it seem out of reach and interim financing difficult.

Knowing that the time of applying for a HUD loan and receiving funding fluctuates and can take many months to years to matriculate the process, most investors will secure conventional funding upfront to purchase their property while submitting applications to HUD for long term financing. This process is typically called a bridge loan and once this loan is secured to purchase the property and is then paid off once the HUD funds are dispersed.

HUD and traditional Property Conditions are vastly different with respect to the scope of work. The risk is that the HUD inspection of the property at the time of funding will require the purchaser to make mandated upgrades to comply with their standards. The additional property data points required by HUD, but not required by a traditional lender, can be somewhat obscure and difficult to navigate. If the investor is not prepared for it, these details could derail the deal after many months of an application process.

WHAT IS HUD LOOKING FOR?

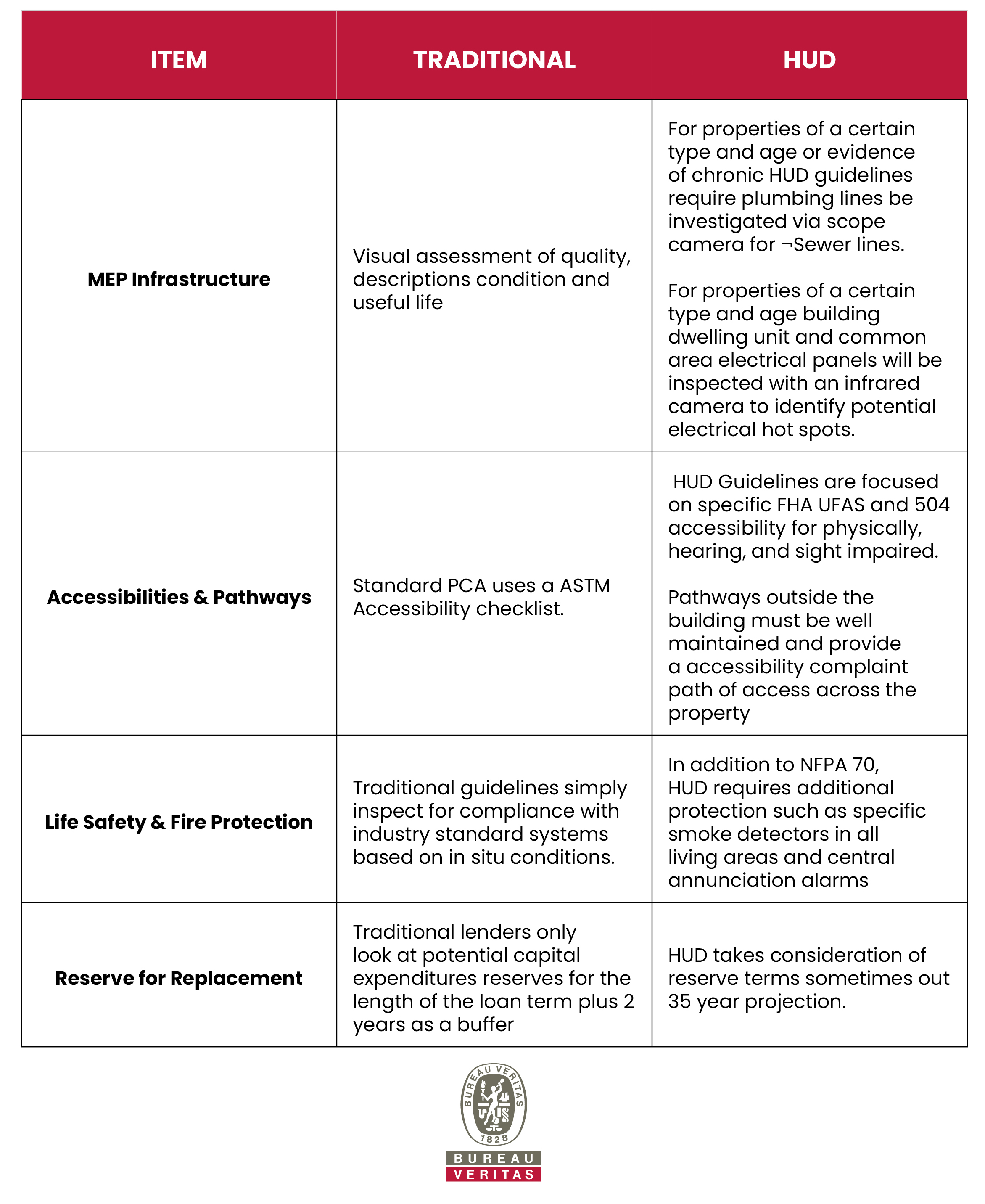

There are many benefits to secure a HUD/FHA loan for a property that makes the wait worthwhile. However, there are key differences between a conventional Property Condition Assessment (PCA) and HUD’s Property Capital Needs Assessment (PCNA) and Environmental Site Assessment (ESA), relating to accessibility, capital expenditures, and disposition remedies.

Accessibility: HUD loans are primarily for multi-family housing and nursing homes. Buildings and surrounding amenities of the property must be able to accommodate disabled individuals. That means ADA compliance in hallways and units, but it also means well-maintained paths and parking lots. These requirements will also extend into fire protection and life safety needs for hearing and sight-impaired individuals.

Capital Expenditures: Most conventional loans will only be concerned with the next 10 years of potential capital expenditures; however, HUD is going to want to know the next 20 years. HUD’s requirement will extend to the current age of infrastructures, such as piping, electrical panels, and the building’s ability to support modern technology. It will even review utility usage to determine the property’s overall efficiency.

Disposition Effect: In the event, a HUD loan goes into default property secured with a HUD loan, there is limited recourse. HUD simply gains control of the property and puts the property quickly into dispositions for resales. That means, they take a special interest in the condition of the buildings and land in proximity to the investment so time on the market is minimal. Things that impact the experience of the property, like noise, vibrations, or proximity of power lines, railroads, major highways, use of surrounding buildings, or similar activities are investigated during the application.

Provided below is snapshot of five specific HUD requirements that most often need to be addressed during the application period and why they are overlooked by a conventional lender.

WHY NOT CONDUCT A PCNA UPFRONT?

The HUD PCNA report will be outdated by the time it is needed for the HUD application if a property owner attempts to conduct it at the time of purchase.

Even though a standard PCA covers all the concerns of conventional loan application and is generally enough due diligence for a potential investor, it’s not enough to satisfy HUD. Then again, the detailed PCNA is considered too much information for the conventional lender. If a property owner intends to secure HUD financing both reports must be done.

HOW TO BRIDGE THE GAP.

Our approach to helping our clients meet conventional or bridge lenders' requirements, while still providing valuable information to flag any items that HUD may look at down the road is what we call a “HUD Look”.

When our team conducts the standard property condition assessment, they outline potential HUD red flags. This doesn’t completely mitigate the risk associated with applying for HUD funds, but it makes it more manageable.

The idea of our HUD Look is to prepare an investor for potential improvements or considerations that will need to be addressed despite their causing little or no issue for securing conventional funding. Each of the outlined concerns is paired with an explanation of what needs to be done to bring the item into compliance with HUD or whether an explanation or further investigation will be required.

By reviewing the property with the end goal of securing HUD financing, our team can:

- Compile the ASTM PCA/ESA formatted for lenders to underwrite the bridge loan. Some of the information required by HUD is too detailed for conventional lenders. We have structured this report specifically to meet the needs of conventional lenders.

- Organize the details of the property for the client to apply for HUD financing and give HUD the information they need about the asset.

- Deliver environmental research that allows the client to understand the requirements and risks of the HUD application.

- Outline the property conditions that would trigger red flags and require remediation before HUD would offer commitment.

- Compose reserve for replacement tables that present the critical, long-term, and short-term needs of the property using the HUD underwriting methodology.

When it is finally time to conduct and submit the PCNA, those original issues identified in the HUD Look have already been addressed and the owner is set up for success in securing their loan.

If you are considering investing in a property that you hope to have financed by HUD, we can help!